Being a mom is one of the most rewarding experiences in life, but it also comes with a hefty price tag. If you have been out of the workforce for a few years, your return to work can be even more difficult as you try to adjust to child care, diapers, baby not sleeping, and a new schedule.

In addition to the stress of those changes, you may also be facing a financial burden as you try to reclaim your career.

However, if you make an effort to budget your money properly throughout the year, it is definitely possible for any mother with or without childcare expenses to get financially ahead.

Table of Contents

Here Are 13 Tips on How You Can Manage Your Money as a New Mom

Assess Your Spending Habits

First thing’s first- take an honest look at where all that money goes every month before trying anything else. Making lists is one way many people have found success in identifying spending patterns they didn’t know existed but had been following subconsciously. Did you realize just how much coffee runs cost each week? How about those dinners out with friends…

Get Organized

Moms need organization more than most adults do because they are so busy. So take the time to figure out where everything is when you need it. It’s not just about preparing for when your little one is screaming in the night and you’re half asleep trying to find a pacifier, but also those times during the day if you’re taking care of multiple children, or even just wanting to catch up on those shows you recorded to watch later. So find a way to keep everything together and accessible as best as possible, whether it is a purse or diaper bag specifically for baby supplies or using baskets in your cabinets to separate things.

Freebies

Freebies from babies’ favorite brands show up online all the time so it’s good to keep an eye out! These brands may give away things like swag bags with various goodies inside, discounts off your first purchase if you subscribe via email, etc., but there are other websites that have even more freebies for baby just waiting to be found—like those offering free diaper samples or being able to print out discount codes right then and there!

Trim The Biggies

Most people have big-ticket items they can cut out of their budget. You might have been using a gym membership you only used once every few months, so why not cancel it? Do you have premium cable channels you never watch anyway?

If so, give them the boot and use Hulu or Netflix instead where you can get caught up on shows for free. It’s also worth looking at your cell phone plan and whether you’re getting the best bang for your buck- I’ve seen people save anywhere from $20 to $50 a month by switching providers and dropping unnecessary add ons like data plans that you don’t need in the first place. If you have an old car, see if it’s possible to drop collision coverage since you rarely drive it, or make it a point to drive less.

Save Up For Splurges

Once you’ve trimmed your budget, put that money aside for small treats throughout the month. Maybe you’ll buy yourself a discounted meal at work, or treat yourself to some new clothes if they are on sale. The key is not to spend it all in one place by saving up for something big, like taking a vacation.

Plan For Projects

If you’ve got some larger ticket items to take care of, plan them out so you won’t be caught off guard when the time comes to pay for it all. Do you need a new car? Start putting that money aside now for an appropriate down payment. You can also ask family or close friends for help with some larger purchases, especially if you are having a baby and need everything from cribs to diapers to car seats etc.

Use Your Resources

If you have any products you aren’t using anymore, sell them on Craigslist or eBay. Or give them away on Freecycle. Many times this is a good way to get rid of things you no longer need and make back some extra cash.

Plan Ahead For The Holidays

If you’re like most parents, Christmas will be here before you know it. And if you already have kids, your holiday shopping list is probably growing by the second! So take the time in October or November to start making up that list and setting money aside for when Black Friday rolls around. You can even try using apps that help you set savings goals for different things so it’s easy to save automatically each month.

Don’t Forget About Your Retirement

It’s important to plan for your retirement, even if you have a baby on the way. Make sure you are taking advantage of flexible spending accounts through your employer, which allow you to set aside up to $2,500 pretax each year towards your retirement. It’s one less thing you’ll have to worry about when it comes time to retire!

Save For Your Child’s Future

I always recommend that parents start saving for their child’s college education as soon as possible, especially since the cost of tuition is only going to go up. There are lots of ways you can save- for example, some employers offer a match on your contributions which means free money! Just talk to someone in HR about your options.

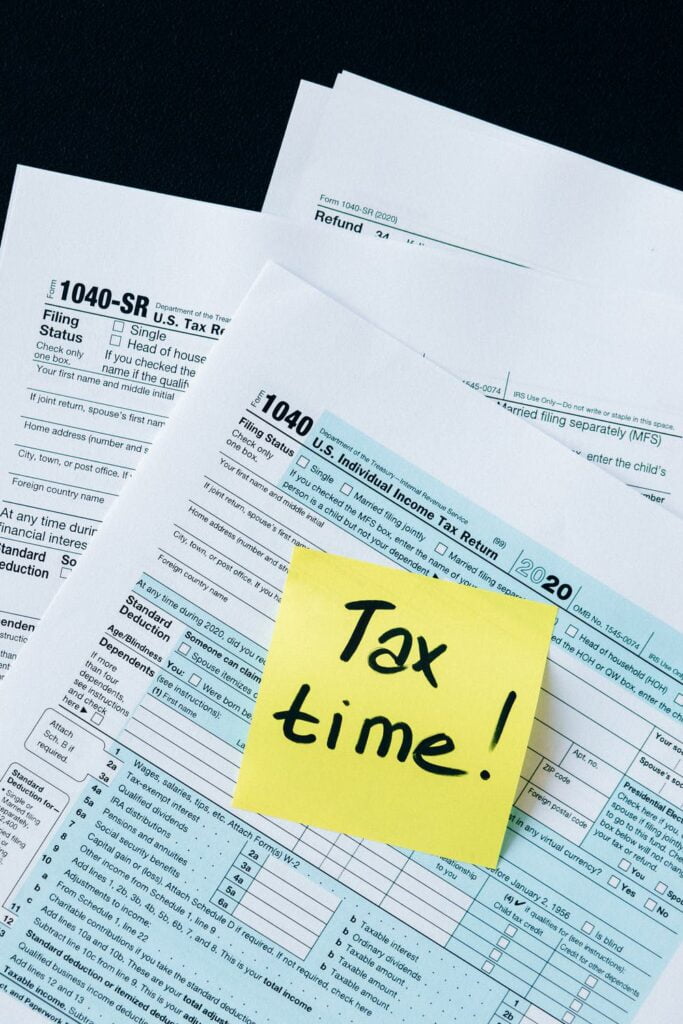

Don’t Forget About Taxes

The biggest thing people forget about when budgeting is taxes! Make sure you include estimated tax payments in your monthly budget so you aren’t surprised come tax time.

Stay On Top Of Your Bills

By staying on top of your bills, you can make sure that no one is overcharging you or trying to take advantage. You can also use online tools to help you track your spending and spot anything out of the ordinary.

Give Yourself Some Reward Money

It’s always a good idea to put a little bit of money away each month as a reward for not going over budget. This is your discretionary money, so spend it however you want!

Plan For Unforeseen Expenses

This is easier said than done, but it’s important to put aside a little bit of money each month for emergencies. That way if something comes up you aren’t stuck scrambling to find the money or pay late fees.

Final Words

This is just a general guide to help you get started on budgeting. There are tons of resources available online that can provide more information on different aspects of budgeting, or how to set up your own personalized system for tracking finances. But ultimately the most important thing you need in order to succeed is willpower.

It’s easy to get distracted and spend money on things you don’t need, and staying focused is the biggest challenge. But once you get into a good rhythm with budgeting, it will feel like second nature and you’ll be able to save lots of extra cash every month!